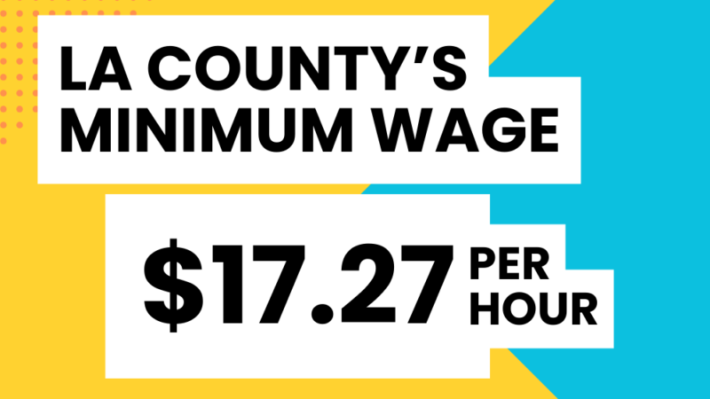

Imagine starting your day with the comfort of knowing that every hour you work is bringing you one step closer to making ends meet—whether it’s covering rising grocery costs or staying ahead on rent. For workers in the unincorporated areas of Los Angeles County, this could become a reality as the minimum wage increased to $17.27 per hour, effective July 1, 2024.

Each year, the county will adjust the minimum wage based on the cost of living, helping workers gradually move towards greater financial security.

This wage increase applies to all employees who work at least two hours a week in unincorporated areas of Los Angeles County. It's important to note that the County has its own minimum wage ordinance, which is different from both the City of Los Angeles minimum wage and the State of California minimum wage, which applies to many other cities.

It’s critical that employers and workers ensure that paychecks reflect the new rate. Workers should double-check pay stubs and look for updated workplace notices showing the current minimum wage rate, which employers must post in a visible place. If your employer hasn’t updated these or you’re being paid below the new minimum wage rate, the Los Angeles County Department of Consumer and Business Affairs (DCBA) is ready to help.

Unincorporated areas include communities like East Los Angeles, City Terrace, Florence-Graham, Altadena, and Hacienda Heights. Not sure if your workplace is in an unincorporated area? You can easily verify your work location by entering your workplace address on the County’s website. This step is important, as only workers in these areas are entitled to the County’s minimum wage rate.

If you’re concerned that your paycheck does not reflect the wage increase, DCBA offers free assistance. DCBA can share information on workers’ rights under the new wage law, investigate employer violations, and help recover owed wages. Workers can file a complaint online, by phone, or via email. DCBA’s services are completely free, and they do not ask for or report immigration status, so all workers can safely claim their wages without risking additional issues. Complaints can be anonymous.

Reaching out to DCBA in 2023 for assistance with wage violations was an important step for workers at two Wingstop restaurants in the unincorporated areas of LA County. After receiving an inquiry from one employee who asked about the correct minimum wage in unincorporated Los Angeles County, DCBA investigated the claim and found over four years of wage violations. The restaurants’ owner-operators agreed to a settlement of $667,414.05, which included employee back wages, fines to employees, and fines to the county.

Employers must update their payroll systems to comply with the new wage. DCBA supports this with free resources, including downloadable posters and notices in multiple languages—English, Spanish, Vietnamese, Chinese, Korean, Tagalog, and Armenian. Compliance isn’t just about avoiding penalties; it’s about ensuring fair treatment for all workers.

In addition to enforcing the minimum wage, DCBA also upholds other vital worker protections, like the Health & Safety Anti-Retaliation laws and the Fair Chance Ordinance, which protect against discrimination and retaliation. If you work in the cities of Santa Monica or West Hollywood, different wage ordinances apply and DCBA is the enforcing agency. DCBA can address any questions regarding minimum wage, hotel minimum wage or paid sick leave laws.

If you’re paid less than $17.27 per hour after July 1, 2024 and work in unincorporated Los Angeles County, don’t hesitate to contact DCBA’s skilled counselors Monday through Friday from 8 a.m. to 4:30 p.m. at 800-593-8222 or via email at wagehelp@dcba.lacounty.gov. You can also visit one of DCBA’s offices during normal business hours:

- East Los Angeles County Hall: 4801 E 3rd St, Los Angeles, CA 90022

- Los Angeles County Hall of Records: 320 W. Temple Street, G-10, Los Angeles, CA 90012

- Lancaster Library: 601 W Lancaster Blvd., Lancaster, CA 93534 (limited hours)

Staying informed is key to ensuring you’re fairly compensated. Make sure your wages are up to date—because every dollar counts.