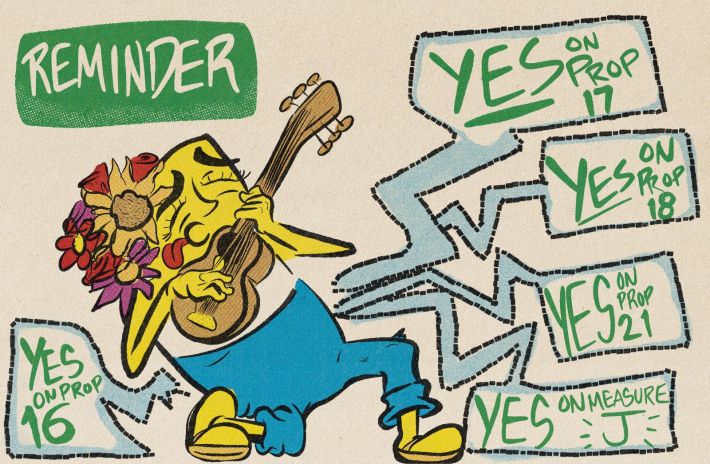

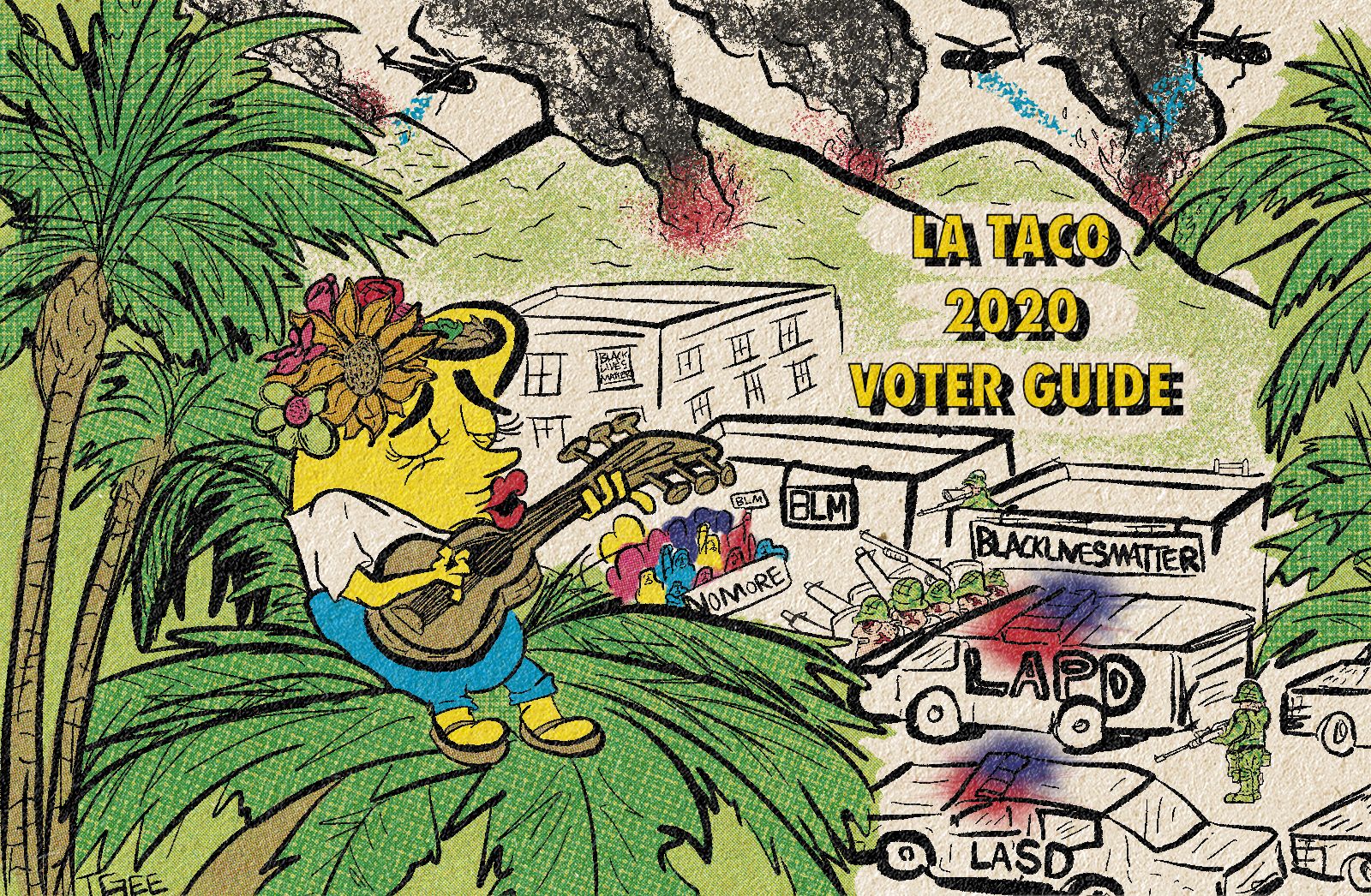

[dropcap size=big]T[/dropcap]his voting season is arguably the most important one in our generation. Yes, the presidential election is happening, but don’t forget about local elections. After all, these have the power to affect you immediately after voting on them.

On November 3rd, when you personally approve or reject a proposition, you are having a say on how your painstakingly-earned taxes get spent. Same with laws and policies that have the power to potentially affect you and your quality of life as an Angeleno. That being said, propositions can be tricky, often purposely written to be confusing and throw off even well-informed voters.

That’s why we examined each proposition and broke them down for you here.

With love and power, L.A. Taco.

Prop 15

Prop 15 is one of a couple of propositions on this year’s ballot that asks you if you want to begin to take apart the eternally damned Prop 13. This proposition was passed in 1978 that allows homeowners and businesses to pay the property’s original property tax rate when they bought the property forever. It’s kind of like if you bought a gallon of gas in 1978 for 60 cents and you were legally allowed to keep paying only 60 cents for that gallon of gas forever. Prop 15 asks you if you want to end Prop 13 for businesses and corporations that own land and real estate worth over three million dollars.

Prop 15 does not affect individual private homeowners at all.

A yes on Prop 15 means you want to make commercial and industrial property owners with land worth over three million dollars, except farmland and other commercial agriculture, start paying property taxes based on their properties’ current market value. This would create a “split roll” tax, meaning this increase in property taxes would affect businesses and corporations, not individual homeowners.

A no vote on Prop 15 means you want commercial and industrial property owners with property worth more than three million dollars to continue paying property taxes tied to the property’s market value when those businesses and corporations bought them.

California has the fifth-largest economy globally, but the top 10 percent of wealthy people in the state have 12.3 percent more income than the bottom 90 percent of Californians combined. California ranks somewhere in the top five or the top ten most economically unequal states in the country based on various measures, including because of the cost of housing and educational inequality. Exact numbers are difficult to calculate, but an estimated 8 to 12 billion dollars per year have been lost in state property tax revenue bound for local governments and school districts since the passing of Prop 13 in 1978. That’s 336 to 504 billion dollars for local social services and schools lost and mostly gained by the state’s largest corporations in tax breaks.

It just so happens that since 1980, two years after the passing of Prop 13, the wealthiest of Californians have seen their incomes grow by 60 percent. The Public Policy Institute of California found that 52 percent of Californians think that the government should do more to ensure that all Californians have equal opportunities. Eight to 12 billion dollars a year more to local schools and to local governments can start to do that. Californians just have to make sure that school districts and local governments spend that money to educate kids and help people.

Prop 16

What is Prop 16? Short story: Californian voters banned efforts to address the under-representation of people of color and women in public employment, contracts, and universities in 1996, AKA, they canceled affirmative action.

This profoundly negatively impacted students of color, public employees, and contractors in the state.

Prop 16 repeals the ban on affirmative action.

Longer story: The language in 1996 was confusing because Prop 209 said it “prohibits the state from discriminating against, or granting preferential treatment to, any individual or group based on race, sex, color, ethnicity, or national origin...in the operation of public employment, public education, or public contracting.”

This law applied to “the state, any city, county, the public university system, the community college district, school district, special district, or any other political subdivision or governmental instrumentality of, or within, the state” of California.

California said discrimination is outlawed, so problem solved, right? Nope. This tricky little proposition BANNED race and gender-conscious efforts to address the underrepresentation of women and people of color in public employment, public contracting, and education.

On top of that, Prop 209 at the time was called the “California Civil Rights Initiative.”

According to a study on the subject, one of the impacts of Prop 209 is that women and people of color lost $1 billion annually in lost contract awards.

A report from the UC Office of the President showed that the passage of Prop 209 also led to a 12 percent systemwide decline in under-represented groups at UC campuses. Underrepresented groups at Berkeley dropped 31 percent.

Black students at UC Berkeley advocated to repeal Prop 209 and helped persuade Assemblymember Shirley Weber to sponsor a bill that would overturn the ban on affirmative action. That bill passed through the CA legislature and will be on your ballot as Prop 16.

Proponents include The Campaign for College Opportunity, California’s three public higher education systems, unions, social justice organizations. The biggest opponent to prop 16 is Californians For Equal Rights (doesn’t that name sound familiar?), they were created to protect prop 209.

They think it discriminates against White students and higher-income students.

CFER president straight up told CalMatters that affirmative action “is really the enemy of white people who are contractors and Americans of Asian descent who are trying to get into the University of California at Berkeley.”

Anyways, I think the choice is pretty straightforward; either you want a more equitable system for people of color in California, or you don’t.

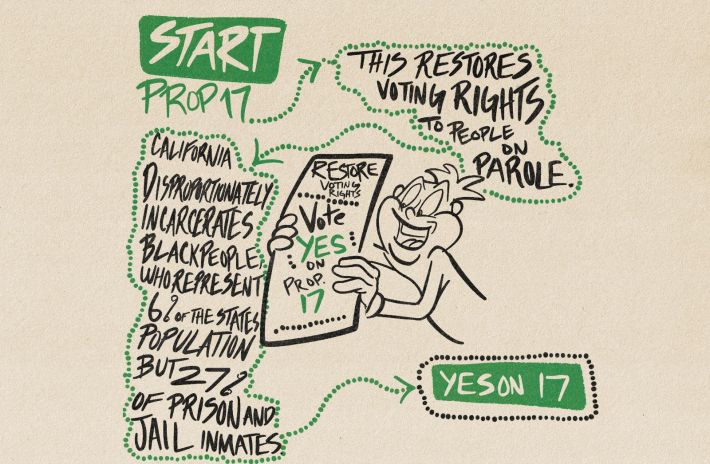

Prop 17

This restores voting rights to people on parole. This means a yes vote would allow people on parole to vote, and a no vote means you want people on parole to continue not to be allowed to vote.

It’s crucial to note California disproportionately incarcerates Black people who represent 6 percent of the state’s population but 27 percent of prison and jail inmates. Parolees not being able to vote is a form of disenfranchisement.

Prop 18

Prop 18 asks if you want 17-year-olds who will be 18 at the time of the next general election to vote in primary and special elections. A yes vote means you want 17-year-olds to be able to vote. A no vote means you don’t wish 17-year-olds to vote.

The main argument against this prop is that 17-year-olds are too young and immature to vote, but magically, they become mature enough to vote when they turn 18.

Eighteen states, along with Washington D.C., already have similar laws allowing 17-year-olds to vote in primaries if their 18th birthday is before the closest general election. Those states that allow 17-year-olds to vote include New Mexico, Mississippi, and Ohio, and everybody knows that those states are run by Tik Tok-ing teens who’ve enacted laws forcing older adults to do the renegade dance.

But for real, young people overwhelmingly tend to vote for more liberal and progressive candidates and causes, and as young people are more ethnically diverse now than at any other time in American history, and young people are showing up to vote at higher percentages. Republicans and conservative politicians and institutions would rather those kids not vote for liberal and progressive initiatives, and vote them out of office. The real challenge for supporters of this prop is, if it does pass, getting 17-year-olds to register to vote, and then those 17-year-olds doing the damn thing, voting.

Prop 19

California’s proposition system is supposed to be this cool experiment in direct democracy where regular people, not politicians or bureaucrats, come up with laws to fix problems they see in their communities. Except that it takes a lot of specific expertise to write laws, and a lot of time and money to mount campaigns to get props on the ballot. Usually, the only things that get on the ballot are written and financed by special interest groups to get benefits for themselves written into the law.

Prop 19 is the purest form of that kind of bullshit.

Voting yes on Prop 19 means you want people who own homes that are 55 years old or older to keep the property taxes they had when they bought the house. Furthermore, you also want those people to be able to transfer that same property tax rate anywhere in the state if they buy a new home, or multiple new houses, even if they buy a more expensive house than the one they had before.

Voting yes also means that people who inherit houses from their folks have to live in that house full time, or the home will be reassessed and taxed at its current, more expensive, market value. The money from those increased taxes on those inherited houses will go into a fund that the state can use to fund firefighters and public education.

Voting no on Prop 19 means keeping things the way they are now, meaning, people 55 years or older can only transfer their old property tax rate to a new home only once, and it has to be a new home in the county they already live in. It also means people will still be able to inherit houses and pay the same tax rates that their parents paid, even if they use the house to rent out and not live in full time.

If you’re asking yourself, why am I voting on this? I don’t want either of these things! I feel you. This is a big giveaway to wealthy Californians and the real estate industry, which, since the passing of the eternally damned Prop 13 in 1978, have sucked billions of dollars from public schools and local governments for four decades now. Prop 19 is like a further extension of the tax breaks in Prop 13. Interestingly, the Howard Jarvis Taxpayers Association, known as the anti-anything tax increase related special interest group named after the leading campaigner for Prop 13, is actually against Prop 19. They think the part about increasing taxes on people who inherit a home and don’t use it as a primary residence is an unfair tax increase.

Governor Newsom, California Professional Firefighters, the California Nurses Association, and the California Association of Realtors are for the bill. That’s California politics.

Proposition 20

Prop 20 is a very extreme “tough on crime” proposition that would undo three criminal sentencing reforms Californians passed within the last ten years. It would push California towards how it was a decade ago when prisons burst at the seams with folks targeted by “tough on crime” laws. It’s worth noting that Californian prisons had a suicide rate that was 80 percent higher than the rest of the country back then.

If Prop 20 passes, someone could be convicted with a felony instead of a misdemeanor if they steal something valued at $250 or more. This is because the threshold between petty theft and grand theft would drastically drop from $950 to $250.

This proposition would also force people convicted of some misdemeanors like shoplifting, drug use, and forgery to submit their DNA to law enforcement.

It also would increase penalties for formerly incarcerated people if they violate their terms of release three times.

This essentially means more that people would end up in prison because it makes it easier to get caught up in the system. There’s a pandemic happening now, and this law would make poverty-based petty crimes punishable at felony levels.

Also, Prop 20 would require the parole review board to consider a “felon's age, marketable skills, attitude about the crime, and mental condition, as well as the circumstances of the crimes committed” before deciding to release a person with a felony on parole.

Notice the bit about “marketable skills.”

Not surprisingly, supporters of Prop 20 include Trump’s favorite Devin Nunes, Association for Los Angeles Deputy Sheriffs, and California Correctional Peace Officers Association Truth in American Government Fund (CCPOA), which represents correctional officers in California. Albertson’s Safeway and the California Retailers Association are also supporters.

The CCPOA spent $2 million supporting Prop 20, and the Los Angeles Deputy Sheriffs also spent $200,000 in support of Prop 20.

Cops and supermarkets, and department stores really like Prop 20.

Opponents include different California ACLU branches, California Partnership to End Domestic Violence, National Center for Crime Victims, University of California Student Association, and the Public Defenders Association.

Proposition 20, if it passes, would cost taxpayers tens of millions each year due to increased jail populations, court-related costs, and the fees associated with DNA collection. Prop 20 would be an expensive way of packing California jails with more Black and Brown people.

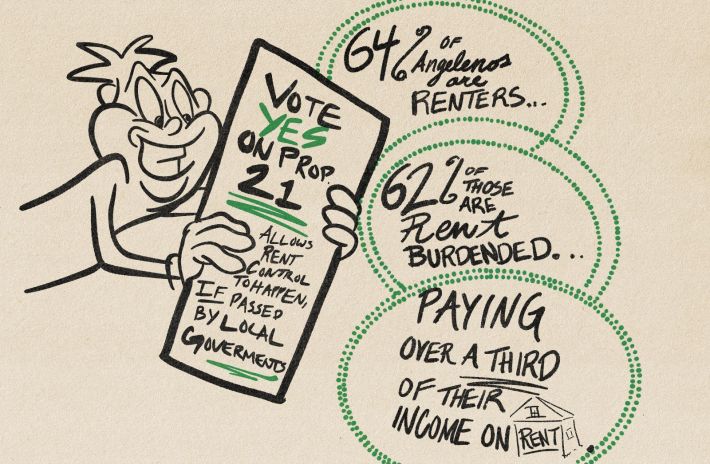

Proposition 21

This is a lite version of the rent control proposition on the 2018 ballot (and didn’t) get voted in. Sixty-four percent of Angelenos are renters, and 62 percent of those renters are rent-burdened or paying over a third of their income on rent. This would allow local governments to control the rent on housing that was first occupied 15 years ago and earlier except small landlords who own two homes or less. It will enable rent control to happen if local governments pass rent control; it does not magically create it overnight. L.A. Taco endorses this proposition.

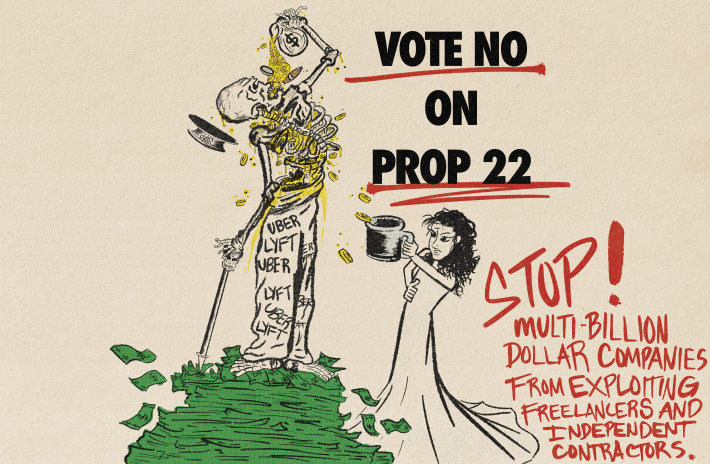

Prop 22

Prop 22 asks, Should people who drive for rideshare Apps like Uber and Lyft, and delivery apps like Doordash and Postmates, and other App-based gig jobs be classified as independent contractors when they sign up to work for those companies? A yes vote means, yes, people who work as drivers for those companies should be independent contractors. A no vote means, no, they shouldn’t be independent contractors, maybe they should be employees of those companies.

What does that mean, though? If you’re not the hustling type or are not a part of the 8.5 percent of workers in the state who are independent contractors, and you’ve never worked for Uber, Lyft, Doordash, or any of the other App-based gig economy companies, just probably just know that these services are so cheap because they make the people who do the things that you want them to do not be employees of their multi-billion dollar companies.

Meaning, the companies don’t have to follow minimum wage or labor laws or give their workers’ health insurance or anything because they’re not full-time employees of the companies; they’re freelancers. A no vote would open the door for these independent contractors to be classified as employees of their companies, meaning they’d have a wage and the benefits of being an employee. The average Uber driver makes around $9.21 an hour, two dollars and seventy-nine cents less than California’s minimum wage.

These ridesharing and gig economy app companies have poured 180 million dollars into the campaign to get you to vote yes on this prop. Their main argument is that making people full-time employees costs too much, so they’ll have to raise their services price.

Remember, these are multi-billion dollar companies. The companies also claim that drivers prefer to be independent contractors. Still, there have been intense unionization efforts and protests of gig economy workers tired of wage theft and of being paid next to nothing for their work for years now.

The gig economy app companies, and other companies across the state that use independent contractors and freelancers, are also fighting for this prop tooth and nail because they desperately want to get out of having to comply with AB 5. The law passed last year in California that mandates that companies classify most freelance workers as employees. It’s not just Uber, Lyft, Doordash, and other gig economy companies that want this prop passed, the national and state Republican Party has set its sights on AB 5, and Uber and Lyft have noticed.

The Yes on Prop 22 campaign donated two million dollars to the California Republican Party.

Prop 23

Yet another prop where you may ask yourself, “Why the hell am I being asked to vote on this?”

Prop 23 asks, Do you want dialysis clinics to have full-time physicians at their clinics when they’re open? A yes vote means that you want dialysis clinics to have full-time physicians in their clinics all the time who will report infection data to the state, and make sure that the clinic doesn’t discriminate against people based on how they get their treatment financed. The prop also requires dialysis clinics to get approval from the state health department before the company that owns them tries to shut the clinic down. A no vote means, no, I’m okay, dialysis clinics don’t have to have full-time physicians be there at the clinic who also reports infection data to the state and makes sure that people aren’t discriminated against because of how they get their treatment is paid. A no vote also means no. A dialysis clinic should be able to shut down whenever they want to.

Why are we being asked to make complicated healthcare policy? The private dialysis industry is a vast, multi-billion dollar business that only gets more profitable as more Californians need dialysis. It’s also an industry with a history of having sub-par and unsanitary facilities, especially for communities of color. The industry has a history of targeting with expensive and agonizing procedures, especially if you pay for your medicare treatment.

Service Employees International Union, or SEIU, has been trying to unionize medical care workers at private dialysis clinics for years. In 2018 SEIU tried to pass Prop 8, limiting the profits dialysis clinics could reap from their patients and forcing them to reinvest in safety and sanitation measures at clinics. The dialysis industry poured $100 million into the campaign to defeat the bill, and they won. Now, SEIU is back with Prop 23, and the dialysis industry has again pumped massive amounts of money into a campaign to fight any sort of damper on their profits.

The main argument against passing this prop is that the prop itself is written poorly. It’s SEIU trying to get revenge on the dialysis industry. It would cost those dialysis companies a lot of money to have a full-time physician at every clinic, forcing clinics, especially those serving poor patients, to close. Reminder: The amount of money the industry makes is obscene. There’s a part of the prop that forces dialysis companies to ask permission from the state health department to close. But also, why the hell do we all now have to be experts on healthcare policy to try to do what our legislatures should be doing, reining in the worst excesses of capitalist exploitation?

Prop 25

Prop 25 is another one of those propositions where you just go, “Damn, is there a right answer to this?” Here we go.

Prop 25 asks you if you want to end cash bail for people waiting for their trial.

A yes vote means you do want to end cash bail and replace it with a system where a judge, using their judgment and the assessment of a computer algorithm to come up with a “risk assessment” on whether or not someone released from jail will come back to court for their trial. If they’re deemed too risky, they’ll stay in jail until their trial. If they’re considered “low risk,” they’ll be released from prison and told to come to court on their trial date.

A no vote means you don’t want any of that, and you want to keep things the way they are right now. Meaning, if a judge sets a bond for you or yours, you can pay that bond if you have the money and get you or another person out of jail and wait for that trial date. If you don’t have the money, you see a bail bondsman, and they’ll loan you the money, and they’ll expect you to pay it back with excessive interest.

There are no stupid questions here. If you don’t know, bail is a set amount of money a judge can issue to someone charged with a criminal offense that people can pay to get out of jail while they await the trial for the crime they’re charged with. The bail money is supposed to be like collateral that you hand over to the justice system to convince them that you’ll come back to court for your trial.

Anyways, I think everyone, except people in the two billion dollars a year generating bail bonds industry, can agree that the idea behind bail is kind of fucked up, right? The idea that if you have enough money, you can get out of jail until your trial, but if you don’t have enough money you have to stay in prison before you’ve even been convicted of a crime. Studies have shown that poor people and especially poor people of color, charged with minor offenses who can’t afford to make bail, will often accept harsher plea bargains, regardless of their guilt or innocence in the case. In a justice system such as we have here in this country that targets poor people and people of color, bail, in many ways, became a kind of tax imposed harshest on poor people and people of color.

In 2018 Governor Brown signed SB 10, a law that ended cash bail in California and put in its place a system of “risk assessment” where a judge, using their judgment, and the assessment of a computer algorithm, decided whether someone awaiting trial should be released from jail or not. Joined by The ACLU of Northern California, Human Rights Watch, and other civil rights groups, the bail bonds industry immediately circulated a proposal to rescind the law. That proposition is this one right here, Prop 25.

The bail bonds industry was pissed that their business would collapse, especially here in L.A., which has the country’s most extensive prison system. The civil rights groups were concerned that ending cash bail gave too much power to judges. Without any oversights over whether or not their decisions on who did and did not get released from jail had any racial or other biases and the fact that the “risk assessment” algorithm that judges were going to use had a history of making racist judgments themselves.

In 2014 Politico reported that a similar “risk assessment” software used by judges in Broward County, Florida assessed Black defendants as overall twice more at risk of skipping their court date as white defendants charged with similar crimes and taking into account the defendant's past criminal record. Furthermore, the algorithm suggested that Black defendants were 77 percent more likely to commit future violent crimes and 45 percent more likely to achieve any other type of corruption in the future.

This finding precedes a long list of stories where algorithms sold to the public as “objective” and without bias are found to reproduce instead similar or even more sinister forms of systemic racism and oppression. Furthermore, civil rights groups fear that ending cash bail could mean that judges could arbitrarily hold people accused of minor crimes tied to activism or political activity in cruel and arbitrary pre-trial detention.

At the beginning of the year, San Francisco ended cash bail and installed their own “risk assessment” algorithm for defendants. New Jersey did a similar thing a couple of years ago. The state’s overall jail population decreased by 44 percent, but data about racial bias in determining whether people are released or not hasn’t been studied yet. Judges in New Jersey don’t have to consult the algorithm, it could be just used as another tool in assessing defendants, and that’s close to what civil rights group encourage municipalities that implement the algorithms do. First, evaluate their decision based on the seriousness of the crime the defendant is accused of and then consulting the algorithm in the context of a framework sensitive to social justice issues.

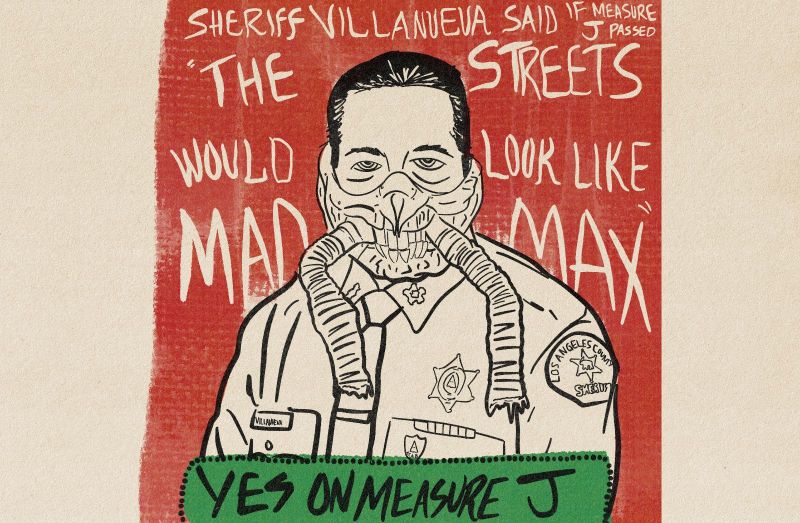

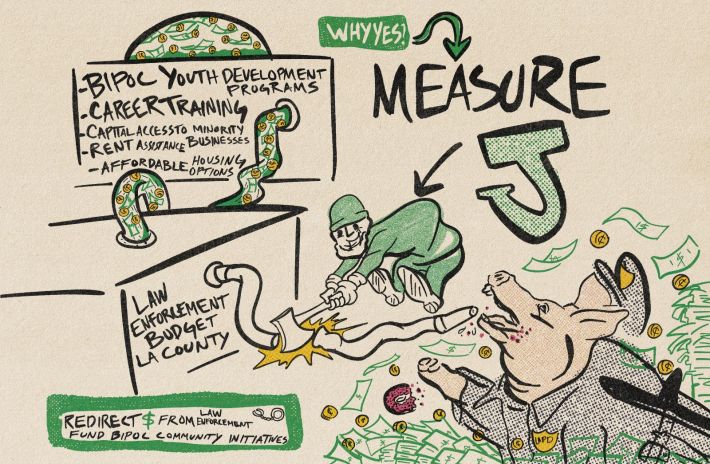

Measure J

This measure ensures that no less than 10 percent of L.A. County’s general funds go to “community programs and alternatives to incarceration, such as health services and pre-trial, non-custody services.” Measure J aims to redirect funds to Black, Brown, and Indigenous people in Los Angeles with youth development programs, career training, capital access for small minority businesses, emphasizing Black-owned companies, rent assistance, and affordable housing options.

It would also invest in community-based restorative justice programs, increase support for pre-trial non-custody services and treatment, community-based counseling, and mental health and wellness services. It redirects funds from the sheriff’s department to underserved communities. Right now, LA County taxpayers spend 1.95 billion on law enforcement and the legal system, a whopping 42 percent of the budget.

The L.A/ Sheriff’s department caused public outrage after sheriff deputies killed Dijon Kizzee and Andres Guardado. The sheriff’s department requested to place holds on both autopsies.

Opponents unsurprisingly include Sheriff Alex Villanueva, who said on Twitter that if Measure J passed, it would “make the streets look like Mad Max.”