[dropcap size=big]S[/dropcap]ilvia Venegas grew up in Van Nuys. She raised her children there. She calls herself a “typical Latina Valley girl.” And now’s she in a fight the likes of which Los Angeles hasn’t seen since the dark days of the Subprime Mortgage Crisis.

It’s a five-year-long battle involving three multi-billion-dollar corporations, alleged illegal lender maneuvering, and one family stuck in the middle during the city’s latest housing crisis. The lawyers and supporters who know her story swear Venegas is a fighter. She’s up against power players in a giant real estate machine, and beat them to a standstill – at least for now.

Her case embodies a little seen front of the housing crisis in Los Angeles, some 10 years after the beginning of the Subprime Mortgage Crisis in 2008. Homeowners are still foreclosed on by loan servicing companies through the practice of dual tracking, despite legislation passed in 2013 and 2014 designed to prevent it.

'She needs to challenge how they got the title in the first place.'

For the past 14 years, Venegas has lived on the same wide suburban avenue, the kind of residential street in the San Fernando Valley that, instead of sidewalks on either side of it, is hemmed in by wild brush, unkempt lawns, and the occasional spindly Eucalyptus tree.

But the Venegases' suburban life could be wiped out at any moment. She and her family are fighting an eviction by Ocwen, her loan servicing company. Venegas said that while she was going through a loan modification in 2013, Ocwen foreclosed on her. She thought they were restructuring her loan, instead Ocwen sold her house at auction right out from under her nose.

That's called dual tracking, a move typically used by mortgage lenders to see if they can get a better deal. Since most mortgages are guaranteed by an insurer, lenders make money even if someone defaults on a loan. This gives lenders the chance to package several foreclosures and sell them at auction. Even at an auction price, the mortgage company comes out on top. By that time, the lender has already made money in interests and fees, and has the insurance to cover any losses. The borrower is left having paid into something of a mutual promise with nothing to show for it.

Dual tracking was a common practice during the Subprime Mortgage Crisis that decimated the middle class and helped spark the nation-wide Occupy movement. It was made illegal here shortly after the California real estate market tanked but not before it created a boon of cheap housing for giant housing companies to pick up and wrench some control of SoCal's rental market.

In Venegas’s case, Ocwen foreclosed more than five years ago and then sold it to a hedge fund named Colony Capital, who then turned around and sold it off to another billion-dollar company called Invitation Homes. She’s been fighting the companies ever since.

RELATED: Mayor Shut Down: Shouting Housing Activists Force Garcetti to Cut Short Speech at USC

The Fight of Her Life

[dropcap size=big]L[/dropcap]ast week, Venegas narrowly beat the latest attempt by Invitation Homes to evict her and her family, but she is due back in court on March 19. She has been in and out of eviction court multiple times.

“For five years I have been living in limbo. For five years I have been living in fear. For five years I have been living in pain — every single year, especially when it comes down to Christmas time, or to my children’s birthdays,” Venegas told L.A. Taco, wiping tears from her eyes.

“They are so heartless. They won’t even talk to me, and take into consideration that I was the one wronged. I wasn’t the one that did anything wrong.”

Silvia Venegas recounted the story on a recent Sunday morning, seated on a couch in her living room. A dishwasher hummed behind her accompanied by a percolating aquarium.

Her husband Jorge can be seen working on his brother-in-law’s red Toyota hybrid in the driveway with one of their three sons, the one who has been struggling with schizophrenia. Another she said, has been diagnosed with bipolar disorder, but has yet to really come to terms with the condition.

It has not been easy for Silvia, but family’s everything for her. “I am no social butterfly,” she said. “I spend all of my time here at home with my family.”

How that happened starts in 2010, when Silvia’s suffered from a ruptured hernia. She couldn’t work. In 2011, she filed paperwork with Ocwen Loan Servicing for a loan modification of her mortgage of $2,300 a month.

She obtained a loan forbearance agreement until 2013. She was applying for another loan modification agreement, when the company foreclosed on her, according to Philip E Koebel, her former attorney.

RELATED: Anatomy of a Rent Strike ~ L.A. Taco Investigates

Subprime Crisis ~ Ten Years On

[dropcap size=big]W[/dropcap]hile the Venegas family fights to hold on to their home, residents across the city are in a housing crisis of their own. They’re struggling with high rent and lower average salaries. Plus, a diminishing supply of affordable housing is making owning home a pipe dream.

Since the Subprime Crisis began in 2008, more than 200,000 single family homes were bought by a handful of these companies at rock bottom prices, and then most were turned into rentals. About three million families were foreclosed on and one million were evicted from their homes during the Great Recession.

Most of them had been taken advantage of by a lender that deployed similar tactics that Silvia and her family experienced. They were “dual tracked,” promised a loan modification while the loan servicing company worked to foreclose on their home at the same time. It’s a “profit at all costs” attitude, Koebel said, that is still happening despite laws passed to stop it.

'It creates new risks of market monopolization, increased housing unaffordability and instability.'

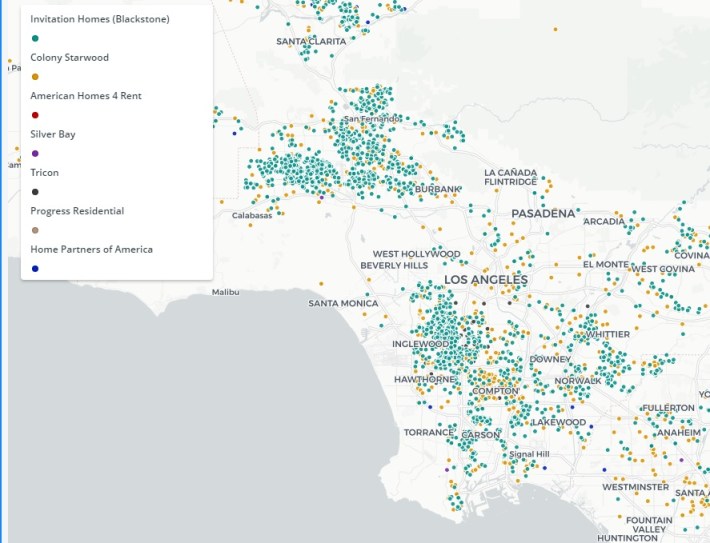

The homes these companies bought were concentrated in areas affected by the foreclosure crisis, and that delivered an outsized impact on individual cities and specific neighborhoods. Invitation Homes scooped up hundreds of single family homes at a time in L.A. County.

In a report by researcher Maya Abood, she described what’s happening as “the financialization" of single-family homes. “It creates new risks of market monopolization, increased housing unaffordability and instability, and new patterns of selective investment and divestment.” That raises a big concern that billion-dollar private equity-backed companies like Invitation Homes are exacerbating the problem of housing costs while they at the same time profit from it.

Invitation Homes is the city's largest landlord of single-family houses. Koebel, who specializes in protecting homeowners from foreclosures, estimated the company owns and operates thousands in L.A. County alone. The company boasts over 80,000 properties in 17 markets nationwide, according its website.

“The company has failed to respond to numerous written requests to discuss a variety of solutions that would enable Silvia and Jorge to remain in their home while allowing the company to recuperate its investment in the property – and even make a profit,” said Joseph Delgado, director of the L.A. office of Alliance of Californians for Community Empowerment (ACCE).

Invitation Homes did not return several requests for an interview on this story.

Five-Year War

[dropcap size=big]T[/dropcap]he day after Silvia’s home was foreclosed in July 2013, she said she got a knock on the door from Abel Castellanos, of Strategic Acquisitions an arm of Colony Capital.

He delivered the bad news, and said he was there to take measurements inside the property. She initially didn't let him, but he threatened her with court actions and bluffed his way into her house, Vengegas explained. He even drilled open her tenant’s door, Venegas recalled. She was renting one of the bedrooms to a family friend, Ernesto Garcia.That later turned into a separate legal action against Colony. Garcia is still living in that room.

Colony did not return several attempts at contacting the company for this story.

'There is no such word as ‘eventually’ when it comes to Silvia Venegas'

In the years, since Ocwen initially foreclosed on her home, Silvia has had to file chapter 13 bankruptcy, fight a losing battle to regain title of her home, and fend off forced eviction suits against her.

“She has fought five and a quarter years longer than what’s supposed to have happened,” said Koebel. “I told her many times that she needed to settle and give up. Ocwen made this dual tracking mistake, but you can’t sue to recover the property. You can only sue to recover damages.”

It’s amazing that she’s managed to fight gargantuan real estate companies to a standstill for as long as she has, but time could be running out for the diminutive Latina Valley girl.

“They keep [effing] up, and we keep taking advantage of it but, eventually, they will do it right. She needs to challenge how they got the title in the first place,” said attorney Elena Popp of the Eviction Defense Network.

Invitation Homes with billions of dollars underpinning their operations, one would expect the company will eventually prevail over the Van Nuys family. “[But] she’s a fighter,” Koebel said. “She’s a champion. There is no such word as ‘eventually’ when it comes to Silvia Venegas.”

RELATED: In Exposition Park, Residents Face Likely Eviction to Make Room For The Fig