Here’s Part 4 of our L.A. Taco Voter Guide, focusing on Measure B, a city initiative that could open the doors for a Los Angeles public bank.

[dropcap size=big]S[/dropcap]hould Los Angeles have its own public bank? Measure B asks voters in L.A. if they want to amend the city’s charter to allow the City Council to look into the possibility of creating one: a city-operated financial institution where all public funds could be directed instead of to private banks.

The measure doesn’t allow the city to create a public bank outright. It just allows it to research the possibility of creating one in the future. But the intent is clear; supporters want an eventual public bank to handle all of the city’s public money, including your tax dollars.

“We’re trying to make banking a public utility,” says Josh Androsky, an activist with Yes on Measure B.

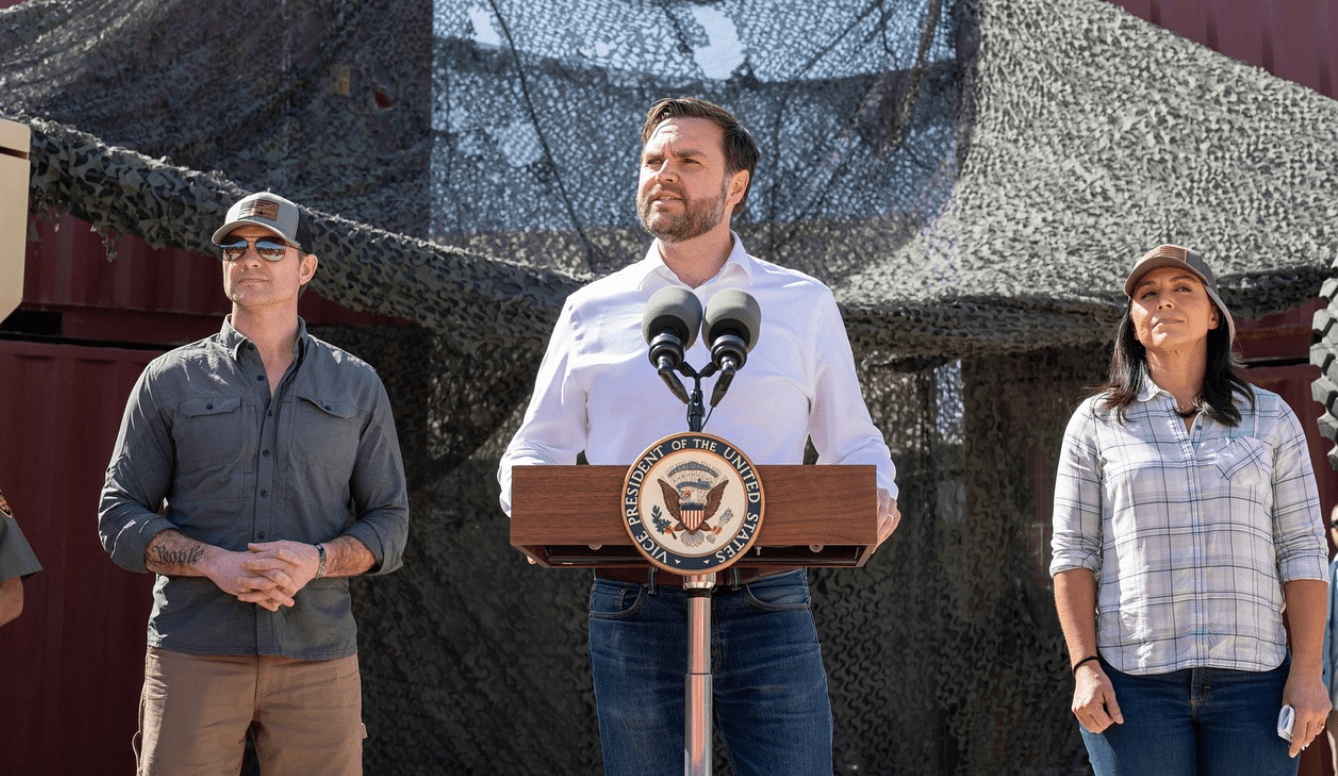

On Saturday, at a rally called a “Defundraiser” on the steps of City Hall, a small group of supporters joined a few high-profile names — like comedian Eric Andre — to rally support for the public bank measure. Organizers said Andre got involved after he happened to meet someone who mentioned the proposal to him. The rally also featured musician Nick Thorburn, and Bernie Sanders impersonator James Adomian.

Andre spoke only very briefly and encouraged attendees to get out and vote on Nov. 6.

These banks were some of those involved in the financial wheelings that lead to the Great Recession.

[dropcap size=big]N[/dropcap]ext year the city is projecting that it will collect $9.9 billion in taxes, part of a steady uptick in tax revenue the city has enjoyed since 2010. After collecting all that money, L.A. then deposits it into multiple bank accounts spread across the huge banking giants, including Bank of America, JP Morgan Chase, and Morgan Stanley.

These banks were some of those involved in the financial wheelings that lead to the Great Recession, then got bailed out by the government, and were heavily involved in aggressively foreclosing on homes. Public funds from cities like L.A. are then used by those banks to loan out money and invest in things like private prisons contracted by ICE for imprisoning migrant children.

Activist groups have pressured the city to divest public funds from for-profit banks involved in financing and supporting practices that undermine the financial health of everyday communities. Just last year, the group Divest L.A. got the City Council to consider taking the city’s money out of it’s biggest banking partner, Wells Fargo, ostensibly for their CRA rating falling — and for being one of the 17 banks that financed the Dakota Access Pipeline, and for being involved in a massive sales and fraud scandal.

If Angelenos vote to approve the measure, L.A. will become one city in a line of other municipal governments who have commissioned reports to study the possibility of public banking.

Oakland initiated a report on the possibility of establishing a regional public bank across the East Bay. The report came out in favor of the idea, but city staffers in the finance department have questioned the rigor of the study, and the legal challenges it could face if it decided to allow banking for the cannabis industry, which can’t bank at mainstream institutions due to federal rules that still classify marijuana as a Schedule 1 banned substance.

In February, L.A. released a preliminary study by the Chief Legislative Analyst, which didn’t put a whole lot of faith in public banking. The report questioned where the money to capitalize the bank would come from, and whether the “exorbitant” price of starting the bank would be worth the effort. The report ended with a call to simply conduct more studies on public banking.

It might seem like public banks are a radical idea without precedent, but the country does have one notable example of a successful public bank, the state Bank of North Dakota. The bank was formed in 1919, pressured by advocates from the Nonpartisan League, a populist organization. Still in existence, the bank partners with other local community banks and credit unions to loan and invest in low-risk ventures and infrastructure projects around the state, including student loans.

[dropcap size=big]O[/dropcap]pponents include the California Bankers Association, which formed a committee called Californians for Financially Responsible Government to campaign against Measure B. Their outreach seems to be limited to a Twitter account that hosts PR videos for corporate philanthropy projects around California by major banks like Bank of America.

The main argument against Measure B is, if the city government can’t handle things they’re supposed to be handling already — like the homelessness crisis, the housing crisis, and traffic congestion — why should we give them the authority to get into the banking industry and screw that up?

Why should we give them the authority to get into the banking industry and screw that up?

But, it seems like the No on Measure B’s main campaign strategy is counting on people just not knowing about the measure’s existence in the first place.

“I don’t think it’s as radical as people think it is,” says Nicolas Duquette, a public-policy professor at the University of Southern California. “There are plenty of other services that are government-run financial institutions, like the F.D.I.C. [the Federal Deposit Insurance Corporation]. A public bank could be run for the city’s benefit, and any profit margin on services stays in the bank.”

“This is a chance to bypass our broken Congress and make actual change that will actually affect our community,” Androsky says. “We’re talking over a ten-year period, maybe using tens of billions of dollars that we can mobilize towards low-risk investments that, get this, saves the world and make us a profit. The only problem would be getting people to do it.”

LA TACO VOTER GUIDE 2018:

Part 1~ Proposition 10 Clears Hurdle For Rent Control

Part 2 ~ Gas Tax Measure Proposition 6 Is All About Hopes of a Republican Revolt

Part 3 ~ Props 1 and 2 Are for Affordable Housing but Come at a Cost